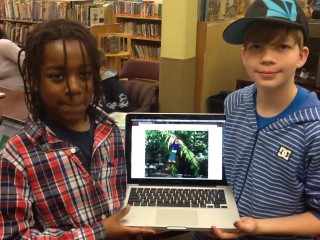

Thanks to math instructor Diane Butler, sixth graders are exploring traditional math skills through a not-so-traditional approach: microlending. Students are mastering complex concepts such as compound interest, discussing real-world financial matters, and empowering people around the world with $25 microloans through Kiva.org, a reputable microfinance nonprofit. The students explore possible recipients, determine credit risk through analysis of online material, and debate the merits of various lending strategies.

“Microfinance is a general term to describe financial services to low-income individuals or to those who do not have access to typical banking services,” according to the Kiva website. “Microfinance is also the idea that low-income individuals are capable of lifting themselves out of poverty if given access to financial services.”

Throughout the past two years, St. Stephen’s sixth graders have made $1,125 in loans — with funds provided as part of the curriculum — and have re-lent the original deposits several times. Their loans have gone to clients in 22 of the 79 countries where Kiva operates, including locations as diverse as Azerbaijan, Kenya, Tajikistan and Timor-Leste. The young entrepreneurs have earned seven of seven possible “social performance badges” offered by Kiva, focusing on topics like anti-poverty, entrepreneurship and more.

Not to be left out, English 6 has joined in the fun with special readings and discussions that enrich the project — a great co-curricular crossover between the two departments.

“Even though I’m a kid, I can still help people around the world have the necessities for education and a way to support themselves,” said sixth grader Jessica Chatham, who has made dozens of Kiva loans with her father. “Plus, it’s fun!”

Chatham encourages all members of the St. Stephen’s community to join the school’s lending team: Friends of St. Stephen’s Episcopal School at www.kiva.org.